Walton EMC is a Co-op

Walton EMC is a cooperative (also known as co-op). The difference between Walton EMC and other power companies is that we are owned and democratically controlled by those we serve. Each person who receives service from this non-profit, customer-owned electric utility is a member – and an owner.

Rural electric cooperatives began back in 1935 when the Rural Electric Administration (REA) was created with the help of President Franklin D. Roosevelt. The REA’s goal was to provide electricity to rural areas and jobs during hard times.

Walton EMC started in 1936 to supply electricity to rural consumers whom investor-owned utilities refused to serve.

The Cooperative Principles

All co-ops operate by a few basic principles. Cooperatives trace the roots of these principles to the first modern cooperative founded in Rochdale, England, in 1844.

- Voluntary and Open Membership

Cooperatives are voluntary organizations, open to all persons able to use their services and willing to accept the responsibilities of membership. - Democratic Member Control

Cooperatives are democratic organizations controlled by their members, who actively participate in setting policies and making decisions. - Members’ Economic Participation

Members contribute equitably to, and democratically control, the capital of their cooperative. - Autonomy and Independence

Cooperatives are autonomous, self-help organizations controlled by their members. - Education, Training, and Information

Cooperatives provide education and training for their members, elected representatives, managers, and employees so they can contribute effectively to the development of their cooperatives. - Cooperation Among Cooperatives

Cooperatives serve their members most effectively and strengthen the cooperative movement by working together. - Concern for Community

While focusing on member needs, cooperatives work for the sustainable development of their communities.

A Direct Voice

Walton EMC members have a direct voice in how the cooperative is run. This aligns with the cooperative principle of Democratic Member Control, which gives members decision-making power.

One way members exercise control is through the annual meeting held every year on the third Saturday in June. At the meeting, members can vote on important co-op issues and elect fellow members to the Board of Directors. This democratic process allows the co-op to be guided by the people it serves.

Who Finances Walton EMC?

Walton EMC is financed by the Cooperative Finance Corporation (CFC). CFC is not affiliated with the government or Rural Utilities Service, thus Walton EMC does not receive government loans.

Capital Credits

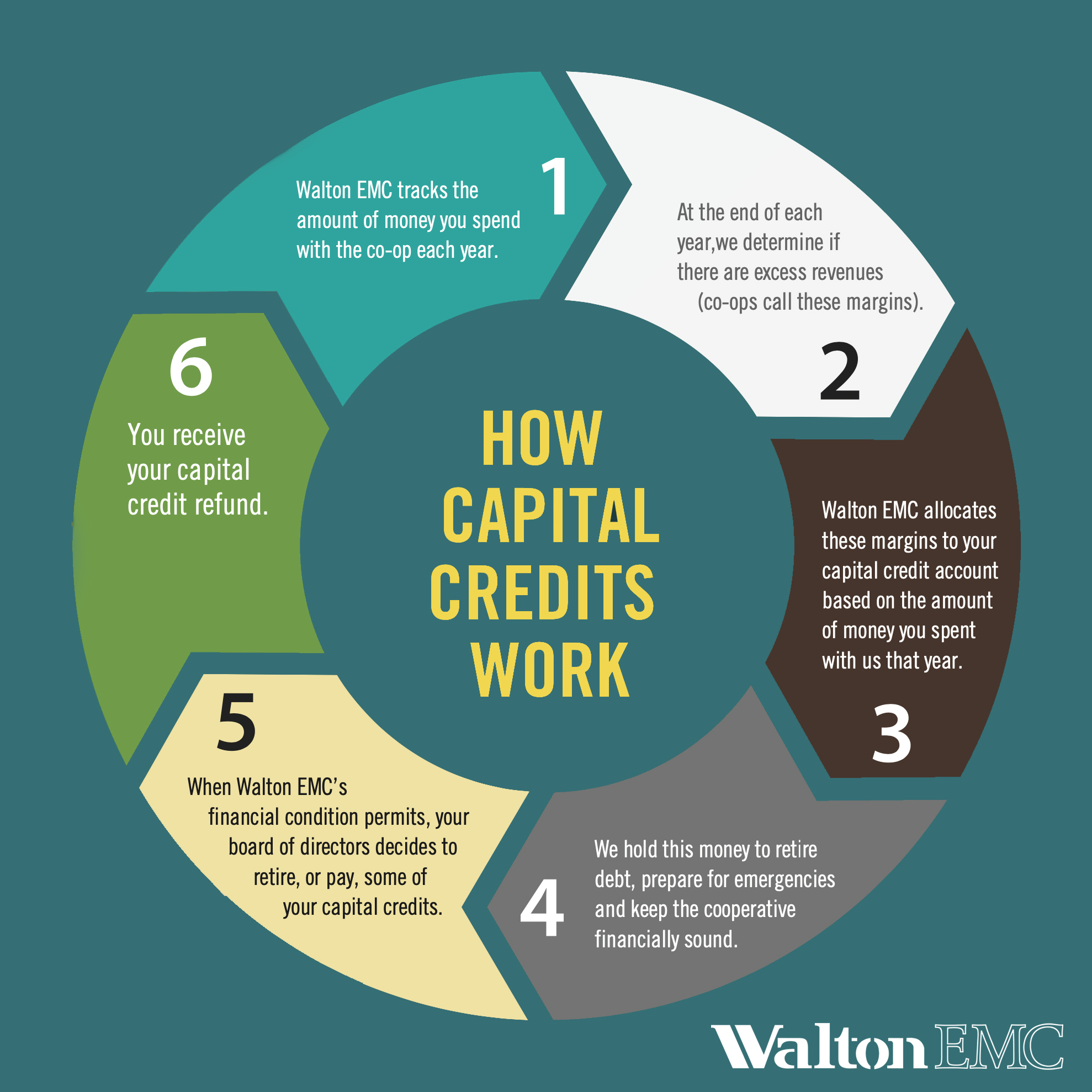

As a cooperative, Walton EMC operates on a not-for-profit basis – we’re not in business to make money, but to provide a service to our customer-owners. A cooperative is a business that is owned by those it serves (members) and operates on their behalf. Capital credits are your share of the earnings of Walton EMC.

As a cooperative, Walton EMC operates on a not-for-profit basis – we’re not in business to make money, but to provide a service to our customer-owners. A cooperative is a business that is owned by those it serves (members) and operates on their behalf. Capital credits are your share of the earnings of Walton EMC.

Capital credits are based solely on how much business you do with the cooperative. Electric rates are set so the co-op charges slightly more than the actual cost of providing electric power. The extra (called margins) are used to pay for capital investments including poles, wire and equipment. By borrowing from its members instead of lending institutions, your cooperative is able to reduce its cost of doing business.

Your share of excess revenues is credited back to your capital credits account. Each year, the board of directors, whom you elect, determines when some portion of your capital credits may be refunded. These refunds are returned as a credit on your power bill.

Learn More:

Contact Us

Call (770) 267.2505 to speak to a Customer Care Representative from Monday through Friday, 7 a.m. – 7 p.m.